Majorities in most of the 24 countries surveyed say the economy in their country is in bad shape. In some places, these concerns color how people think democracy in their country could work better: by focusing on economic conditions and jobs. Economic reform, including issues like taxation, jobs, inflation and wealth inequality, ranks in the top 10 issues coded in the vast majority of countries surveyed. But it’s a particular concern in the middle-income countries surveyed – Argentina, Brazil, India, Indonesia, Kenya, Mexico, Nigeria and South Africa – where the issue is typically in the top three.

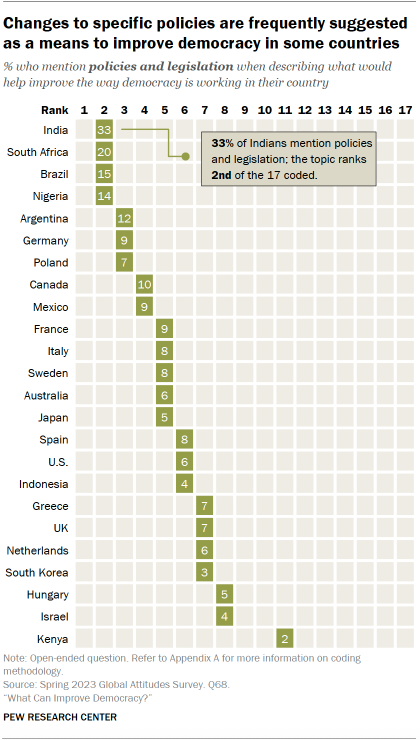

In each place surveyed, people also suggest specific policies and legislation they think would improve their democracy. In some middle-income countries, the emphasis is on infrastructure and basic services like electricity and clean water. But proposed policy and legislative changes extend to issues like health care, housing, immigration and more. Any specific policy change people mention that is not expressly covered by other codes is captured in this topic.

Economic reform

Indians and South Africans stand out for the emphasis they place on economic reform. In both countries, it is the top issue mentioned, with around a third of respondents in each country bringing it up in their open-ended response.

In the eight middle-income countries included in the survey, economic reform appears in the top five issues of the 17 coded.

Economic reforms are seen as an important way to improve democracy in high-income countries as well, ranking among the top 10 most cited issues in nearly every country surveyed.

“Democracy would improve by making more people work and getting them educated. When one has a job, they feel more gratified: education and more work.”

Woman, 76, Italy

The types of economic reform people highlight largely center around three issues: improving people’s day-to-day economic situation (“More jobs for young people.”); changing the government’s economic priorities (“The government should work with Kenyans to ensure development is achieved.”); and, in some cases, changing the economic system altogether (“Stop allowing capitalism to trump human values and decency.”).

Improving people’s day-to-day economic situation

In middle-income countries surveyed, people are especially likely to mention a desire for more or better jobs. Sometimes, what drives their response is personal, as in the case of an Argentine woman: “More work. That they give me work, that there are fewer poor people, that there are fewer children begging in the streets.” Others focus more broadly on employment in the country: “People need to have jobs and prices need to be affordable,” said an Indonesian woman.

“We want jobs, and we want to be heard.”

Woman, 30, South Africa

Employment for the young is a particular concern. For example, a Japanese man said, “Create a society where young people can work easily by eliminating disparities and providing stable employment.” Others emphasized that a core problem was with education not leading to jobs: “More work for the young people who just freshly graduated from school,” said an Indonesian man. In Spain, one man expressed frustration that his government supports but doesn’t employ the country’s youth: “Improve the employment situation in Spain for young people and stop giving aid left and right, only give jobs.”

Worries also exist when it comes to jobs for older people. For example, a woman in Mexico wished “that there would be more work for the elderly because there is more work for young people than for adults.” A man in Italy expressed a similar opinion: “There are many people who do not have the possibility of working, of having a social life, and I would like a state that represents us more, like the elderly and the those in need.”

Concerns about where people can find jobs are also top of mind for some respondents. For example, one Mexican man was concerned with “brain drains,” the phenomenon of people moving abroad for better work prospects: “That there be more opportunities for those in Mexico and not have to migrate to another country.” Others emphasized that good jobs may be located in one part of their country but not another. For example, a British man frustrated with regional divides in his country said, “Nothing much goes north. There is far less work in the North than the South.”

Inflation

“Inflation should be decreased. People should get employment. The prices of gas should be reduced.”

Woman, 26, India

The general increase of prices has impacted many economies over the past few years, and the desire to curb inflation and get prices under control is an economic reform many respondents want. “Lower prices, we are starving,” said an Argentine man, underscoring the severity of the problem. The survey in Argentina was conducted prior to the country’s November 2023 elections, in which severe economic problems were a clear focus.

Others spotlight the price of specific goods, as in the case of one Indian woman who said, “Inflation should be less. Cooking gas should be less expensive. Petrol rates should be less.” Some were specific in the interventions they wish to see to combat high prices: “As the cost of living increases, they should also increase the salaries,” said a South African woman.

Changing the government’s economic priorities

How the government raises and spends money – and what it spends money on – is also an area of focus.

Some see the need to address taxation, including raising taxes on those who can afford the cost. One American woman said, “Start taxing the rich and corporations better.” Others want taxes to be more equitably paid – and enforced – including an Australian woman who called for “taxes on all companies and people. The very wealthy should pay their fair share of tax. No loopholes, so they don’t get out of doing the right thing.”

Other people were interested in reforming the tax system or reducing taxes altogether. “We should also look at changing our tax system, where everyone pays the same thing,” said a Canadian man. A Swedish man suggested that “tax money is earmarked for different parts of society that benefit all people.” An Argentine woman called for her government to “lower taxes and increase salaries.” In contrast, a respondent in Japan wanted to see more but better-implemented taxes: “Taxes will have to increase, but I want how it’s done to improve.”

Adjust spending priorities, focusing on economic inequality

For many, economic reform necessitates providing more financial aid to people in their country who need it. “Perhaps more money for people who do not have a decent income,” suggested a Canadian man. A woman in Australia suggested, “Raise the welfare payments to reduce the socioeconomic gap between lifestyles. By having it at the current level, not being able to afford basics, let alone luxuries, affects your outlook on life, your status in the community, your mental health and self-worth as a citizen.” In a few countries, the suggestions relate to specific national programs: “Cut R350 grants and create jobs to ensure that household has at least one working member,” said a South African woman, citing the country’s unemployment assistance program.

“Raising the minimum standard of living and eradicating poverty so that the working class is able to participate more fully in our democracy.”

Woman, 29, U.S.

The focus on helping the poor is related to general concerns about inequality – especially the notion that “the growing divide in between rich and the poor can affect democracy,” as one Australian woman put it. “Having more connectedness between poor people and rich people in the Netherlands is very important for good democracy,” explained one Dutch woman. A Mexican man suggested that financial aid would improve inequality, saying, “More money should be given to the poor, so that there is more equality among all Mexicans.” (For more on individual rights and equality, read Chapter 4.)

Some specifically see targeting economic inequality as a way to combat other forms of inequality. For example, a woman in Israel said, “Help the poor in the Arab community. Financial help for matters in Arab society.” And in Germany, a woman suggested, “More equality between East and West, between rich and poor.” In the U.S., a man drew a connection between taxing the wealthy and systemic racism: “When the rich pay their fair share of taxes, people of color will have a better chance at the American dream.”

Cutting benefits and spending

Still, some level criticism against their governments for providing too much to the poor in the way of financial aid. A woman in Australia said, “Too many handouts at the moment. The only way to sustain that is to take from those that are hardworking in the way of taxes.” A French man saw this as an issue tied to immigration as well: “It is necessary to give more means to those who work and then to stop welcoming people who are there to take advantage of the system rather than to integrate.”

Others see a need to spend less or differently: “France must start by reducing spending. We must work more and reduce spending at the state level,” said another man in France. An Argentine man wanted to see less spending by way of smaller government: “Reduce the number of public employees and the tax burden.”

Economic independence

“I think we stop importing things from other countries and focus more on exports so that we can grow the economy.”

Man, 22, South Africa

One governmental priority several people stress is prioritizing domestic production so that “our economy becomes more independent,” as a Polish woman put it. A French man explained: “More local consumption. Stop importing things in times of crisis and favor things that are closer, especially food, because people buy a lot of things like that, and it becomes more expensive.” Agricultural independence was the focus of a South African man, too, who suggested the government “create more jobs, specifically farming, so that we won’t import from other countries.”

For one respondent in the Netherlands, dropping the euro would also be valuable: “Get out of the eurozone. Guilder time was the time where things were a lot more stable, and life was a lot better,” he said, referring to the national currency used until 2002.

Restructuring the economic system

“It’s not so much democracy, it’s more to do with capitalism. We need a socialist system so that people and animals don’t go hungry, homeless or cold. There needs to be more equality for all and less of a class system.”

Woman, 60, Australia

Certain respondents see a need to rebuild the economy system in its entirety – by ending capitalism, for example. A man in Canada explained: “Somehow, we need to divert from the course of believing that a free market will end up with the best outcome. To put it simply, an ideological shift away from capitalism. A system where those who own everything are the most powerful just doesn’t make sense.” Similarly, a South African man suggested “changing capitalism into communism.” A man in the U.S. said, “Eliminate capitalism and care for people rather than profits.” And a Canadian woman suggested that “society be more socialist and less capitalist.”

Policies and legislation

Some see room for their democracy to improve through changes to specific policies, though what those policies are varies widely within and between countries. While the general sense is that “there should be policies that make life easy for the common man,” responses collected include reforms to immigration laws, health care policy, foreign affairs and more. There are also frequent mentions of infrastructure development and improving access to basic needs like water, electricity and household plumbing.

“We don’t get water here. There are no proper roads. There are no health care facilities.”

Man, 37, India

Specific policy changes are especially common in several of the middle-income countries surveyed.

Some responses address one issue; others address several, like this list from an American man: “Gun reform, criminal reform, immigration reform, a balanced budget law, security, Social Security and Medicare, and a national abortion law.” Given the diversity of issues included, there are few consistent demographic patterns in who offers policy changes.

And while common topics – education, health care, immigration, infrastructure and so on – are explored in the sections below, there are many responses that are more unique or country-specific:

“More technology, less paper and pencils.”

– Man, 22, Mexico

“First, we have to maintain the population. Rather than addressing the declining birthrate, the burden of child care should be reduced.”

– Man, 42, Japan

“It would work better if the official languages were recognized.”

– Woman, 32, Spain

“Ban assault weapons and strict rules and background checks for those buying guns.”

– Woman, 71, U.S.

“For the wildfires, the Greek people should engage in the deforestation of the fields. The state should not compensate those who do not clear their fields. A law can improve the situation.”

– Man, 74, Greece

“Get on the clean, renewable energy bandwagon … wind farms and solar as far as the eye can see please!”

– Man, 40, Australia

“We should reintroduce general conscription for everyone over 18. Women as well as men. It is useful for everyone to stand up straight for a period of time in ‘ugly clothes’ and obey some orders.”

– Man, 72, Sweden

Education, health care and housing

Many of the responses that address policies and legislation mention education, health care or housing. In fact, these issues are sometimes talked about together, as in one Mexican man’s call for “better schools, better hospitals.” A Hungarian said, “Democracy has a wobble! Education, health care. Pay good salaries to workers at both places.” And an American man included access to affordable housing, education and health care in a lengthy list of suggested reforms.

“More subsidies for social affairs. More social housing, social support, a better school system. Better psychological help, better youth care. Cheaper and more public transportation. More nature protection and more heritage protection”

Woman, 48, Netherlands

When it comes to health care, it’s typically access and cost that concern people. An American woman said, “Give us free health care.” An Italian said, “Citizens’ right to health care should be strengthened.” And in Mexico, a man requested that there be “no shortage of medicines if they are needed.” In Brazil, one woman noted that the issue is with “service at health clinics because there are a lot of delays.”

The same is true of housing: Those who mention it are mostly concerned with affordable access. For example, one young Australian woman said “a fair housing system” would improve her country’s democracy. A man in Argentina said “everyone having their own home” would help.

Pervasive calls for education reform

Bolstering education is also a key focus – whether it be building schools or improving how things are taught. One Spanish woman said that, for her, “The main thing is good education, it is essential. As long as we do not have a quality education, we have nothing.”

There is cross-national understanding that quality education in civics and history is important to democracy:

“Express all of our history – the good, the bad and the ugly.”

– Man, 65, U.S.

“It is necessary to learn the structure of democracy, the structure of the economy, the structure of politics from an early age.”

– Man, 58, Japan

“Teaching comprehensive civic and political education in primary and secondary schools.”

– Woman, 60, Italy

“More education for people about how it works, and what they can do to participate. Info needs to be easy to understand.”

– Woman, 40, Australia

(For more on how people think citizens should be informed in order to vote and participate in democracy, read Chapter 4.)

But some are concerned with specific topics that may be taught in schools. One American woman said, “So many young people are being indoctrinated and told how great socialism is. They need to hear the truth from people who lived in Cuba or Venezuela. Perhaps that will open their eyes.”

Others are mostly focused on the cost of education, including a woman from Indonesia who said, “Don’t make the education fee expensive. It has to be cheaper as it used to be.” Another woman, from South Africa, felt similarly, saying, “Children must get free education and loans.”

Infrastructure and electricity

Infrastructure is a particularly frequent topic, especially in the middle-income countries surveyed. One South African man simply requested “more infrastructure and development” to improve democracy in his country.

In India, where nearly one-third of respondents propose some policy change, there are myriad mentions of better roads, improved drainage and waste management, and access to water. Respondents in India were also quick to bring up agriculture and suggest improvements to the infrastructure that supports it: “making the water supply available to farmers,” for example.

South Africans also focus on basic infrastructure improvements as a critical step to improve their democracy. One woman wanted the government to “build more houses for the poor and fix the tar roads and close potholes.” Another said, “Build us roads and clinics.” Several South Africans took issue with Eskom – the country’s public electricity provider – and the practice of loadshedding, which involves restricting electricity use for long periods of time. Better access to electricity is also mentioned in Nigeria and India.

Immigration policy

In several countries, people say that their democracy would be better with changes to immigration policy.

Some want to end immigration to their country, like a Dutch man who said, “I am absolutely against all those foreigners coming to the Netherlands.” A woman in South Africa said, “Rebuild our country with no foreigners and it will all fall into place.”

Others want to make their immigration system less complicated for those moving to their country, like an Australian man who said that “clearing up the backlog of visa applications and closing some of the loopholes in the visa system that are unfair to applicants” would make democracy better. A Briton shared similar hopes to make the immigration system more efficient: “We have an immigration problem in this country. The structure is not run right and needs reorganizing of the format allowing people into the country.” One man in Canada went so far as to suggest his country “help the poor people of the world come to our country. Open up borders and let immigrants come in and have a life; share some of the riches we have here.”

A few people spoke to the rights of immigrants who come to their country specifically for work: “That everyone can work, even if they don’t have papers. If a Spaniard doesn’t want to work, give it to whoever wants it,” said a woman in Spain. An Australian woman expressed interest in some state support for immigrants, saying, “They should be given some help but have to work for a living.” And in the U.S., one older man pushed for “a thoughtfully bipartisan process of amnesty for gainfully employed immigrants.”

Foreign affairs and multilateralism

Another policy area people in several countries address is foreign affairs. Some are keen to reduce the role their country plays on the international stage – others want it to increase. One American remarked, “The U.S. should stay neutral when other countries have disputes,” while another said that “Russia and China must be stopped, or the United States will be in deeper trouble than it already is.”

“I don’t think it’s a good feeling to be at the mercy of America.”

Woman, 52, Japan

Similarly contradictory opinions exist about multilateral organizations. A Spanish man said his country should “respect national sovereignty and not be aware of the mandates of foreign organizations.” Meanwhile, one of his fellow countrymen wanted “greater protection of the European Union over Spanish laws.” In Poland, multilateralism is particularly popular, exemplified in responses like, “We need a stronger NATO,” and, “Listening to the EU more.”

In several countries, there is a desire for the government to focus on domestic issues rather than international or multilateral ones. One Canadian said, “We need to stop taking policies from global organizations like the World Economic Forum, NATO and the World Health Organization. We need to put our country first and have to stop giving money to other countries to fight proxy wars that have nothing to do with us.”

(For more on views of international engagement, read our December 2023 report, “Attitudes on an Interconnected World.”)